Pass Travel UPDATE January 28, 2015

1) Travel page on Flying Together gets a makeover!

.

The Travel page has been refreshed and is now more user-friendly!

Sign into https://flyingtogether.ual.com and click on the Travel tab. You will see handy new links to “Book a Flight” (employeeRES), “Update Pass Riders” (My Info>PassRiders), “Pass Travel Report”**, “Route Maps” and “Employee Discounts” right across the page. On the right side is a search box, different ways to travel (on UA, myUAdiscount, Other Airline travel, etc), Q&As, and helpful contact information. Important Advisories are in the middle of the page and the familiar links are in the left column.

The new layout is easier to navigate….check it out today!

Remember, you must log into Flying Together at least once every 90 days to avoid getting kicked off the island! If your account gets suspended you should click on “Reset Password” at the bottom left of the log-in page. Or call the IT service desk for help: 800-255-5801.

**See our comments about the Pass Travel Report below in 4c.

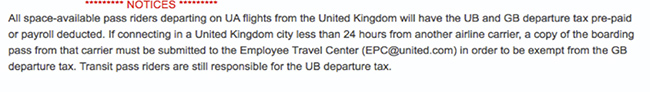

2) Get some departure taxes refunded if transiting

.

SEE UPDATE BELOW...do not send boarding passes to EPC@united.com

Pass riders may get a refund on some pre-paid departure taxes when transiting from another airline to United in certain international cities. When listing in employeeRES, pay attention to a pop-up notice in step #4 of the booking process. For example; when transiting London from another carrier, then pass riding on United Airlines to the USA in less than 24 hours:

So, what is the “GB” departure tax? It’s the “U.K. Air Passenger Duty”, which amounts to over $100.00 per person! Visit the Pass Travel Calculator to see for yourself (employeeRES>Quick Links> Pass Calculator). If you transit London (in < 24 hours) to the USA, be sure to keep the other airline inbound boarding pass to send to the Employee Pass Charge Team (epc@united.com) for the refund!

Many thanks to Carol Schmus (HNL RAFA) who passed this info to us. She discovered 50% of the Japanese tax can be refunded when transiting thru Narita on the same calendar day. Like the UK departure tax, save your inbound other airline boarding pass so that you can send it to epc@united.com for assistance with your refund.

Regardless of what city you are leaving from (LHR or NRT), the departure airline must be United. The EPC Team cannot adjust any departure taxes you paid on another airline.

Please Note: If the city you are transiting offers a refund or exemption it will be noted in step 4 of the listing process in employeeRES. If there is no notice, there is no refund/exemption.

UPDATE January 2018: The ETC will only accept an electronic/scan copy of the other airline boarding pass. You may take a photo of the boarding pass and upload it through Flying Together > Employee Services > United Service Anywhere > Employee Travel Center > Offerings > input "Adjustment to Transit Tax" to fill out form and add attachment.

3) United app makes pass travel easier

Posted December 18, 2014 in the United Daily

Did you know that as a pass rider you can take advantage of many of the same features that customers can when they use the United app to help manage their travel? All the same features are available to pass riders except the one that allows you to change your seat (that's available only if you are a positive-space traveler). Visit united.com to read our press release on the top 5 ways the United app is your best holiday travel companion.

To use the United app for pass travel, just create a pass rider travel plan in employeeRES, then open the United app on your iPhone, iPad, Android, Windows or Blackberry device. Add the reservation either under "My Reservations" or in the travel wallet (top right icon) by choosing "Add a current reservation." If your flight is within the 24-hour check-in window, you can even use the app to complete check-in.

The United app offers additional tools for non-revenue travelers:

• "View boarding totals"

• "View standby list" links you to pass rider details, including pass class and abbreviated board date

• "Change your flight" is an easy way to modify your itinerary without re-listing. Alternate flights will list, with a summary of the passenger boarding totals and a link to the standby list, to view at-a-glance seat availability and the standby list of alternate flight options for the same route.

• You can monitor the standby list on the flight status screen. Refreshing this screen on the app is the quickest way to see when agents are clearing standbys on the flight.

• Signing up for flight status push notifications will notify you when a flight has left the gate, taken off, landed, arrived at the gate, etc. It's helpful for monitoring pass riders' travel, particularly if you’re meeting them at the airport.

• In the event of a delay, using "Where is this aircraft coming from?" on the flight status screen is an easy way to follow a plane from its previous destination. It’s a feature unique to United.

If you have questions about pass travel, please direct them to the Employee Travel Center at etc@united.com or call the ETC at 877-825-3729. From international locations use: 847-825-3729

4) Imputed income taxes and 1099s from United

If your “taxable pass riders” accrue more than $600 in imputed income in a fiscal year (flights flown between November 1st and October 31st of the following year) then you’ll receive a 1099-MISC from United via US Mail. If your pass riders accrue less than $600 then you do not get a 1099-MISC form and you do not have to declare any imputed income on your tax forms.

“Imputed taxes” on airline pass travel are complex, as are most things in the IRS code. Retirees should CONSULT their CPA to verify all these points.

A. What are Imputed Taxes and how are they computed?

1) The IRS requires that employees/retirees pay tax on the “Pass Travel Value” of their pass riders’ travel. If your “taxable pass riders” accrue enough Pass Travel Value in a fiscal year then you, as the retiree, may have to pay the IRS “imputed income tax”.

2) Retirees' “taxable pass riders” are: enrolled friends, domestic partner (same or opposite gender), non-dependent kids 18-25, and same-gender parents (employees’ buddies are also taxable). Pass travel is not taxed when used by the retiree, their same-gender spouse, dependent children up to age 25, and opposite-gender parents.

3) "Pass Travel Value" is calculated to be 10% of the lowest unrestricted B or Y economy fare charged on the day of travel (regardless of where the pass rider is seated; FC, BC or Y), minus any service charge the taxable pass rider may have paid for that flight. If the pass rider did not pay a service charge, then the Pass Travel Value would be 10% of the economy fare that day. Pass Travel Value is also called “Imputed Income”. ……………………………………………………………………………………………………………………FYI: As of March, 2012, United retirees no longer have buddy passes, “buddies" or "companion passes"…..we have “Enrolled Friends”. EFs generally do not pay service charges, they usually fly free as all economy class travel is free. They only pay service charges when flying in a premium cabin (FC, BC) if the retiree has less than 25 yrs of service. Service charges are waived on ALL travel for pass riders of retirees with 25+ years of service. Employees’ buddies pay a much higher service charge to fly, which off-sets or eliminates the imputed income taxes that employees may owe. Now that retirees have EFs instead of companion passes or buddies, we retirees are more likely to pay taxes on “Pass Travel Value”.

4) If the sum of all your taxable pass riders' imputed income is $600 or more during the fiscal period (Nov 1-October 31st), then United is required by the IRS to send you a 1099-MISC form to be declared on your income tax forms.

Example (hypothetical estimates): If the SFO-KOA one-way economy fare is $1,000 then the Pass Travel Value of 10%= $100. The svc charge for an EF to sit in a premium class seat SFO-KOA is approximately $60.

IF your EF got a premium seat and had to pay svc charges, you (or your EF) paid $60 to United when listing. Then the segment would accrue $40 in imputed taxes ($100 value minus $60 svc charge = $40).

IF your EF did not pay a service charge, the SFO-KOA segment would accrue $100 in imputed taxes.

Fortunately, United computes all that data. Otherwise it would be a nightmare for us to determine what’s 10% of an unrestricted B or Y economy fare on any one day (fares can change daily) and what service charges (if any) were paid for every trip our taxable pass riders took last year.

Note: Everyone must pay applicable international departure taxes and customs fees regardless of seniority; those are not “service charges” and they are not deducted from the 10% economy fares to determine imputed taxes.

B. How much tax do you have to pay for your Enrolled Friend’s travel?

OK….Let’s say your EF accrued $800 in imputed income last year (four roundtrips to KOA). That’s more than $600, so you got a 1099-MISC from United.

Do you have to pay $800 to the IRS? NO!

You declare the $800 on your tax forms and it’s added to your other income, like that $16,000 you received from Social Security. If you don’t have any additional income, dividends, interest, deductions, etc, you would pay the IRS income tax on $16,800.

If you happen to be in the 25% tax bracket, the tax you owe the IRS would be $4,200. Without the imputed income, you would probably owe the IRS $4,000 (25% of $16,000).

So…your Enrolled Friend’s four trips to KOA cost you $200 in imputed income tax.

In this simplified example, the $200 is 25% of $800.

Naturally your situation will be different than this example…I know retirees who had EFs accrue over $5,000 in imputed taxes; it actually bumped the retiree into a higher tax bracket! So…read the “bottom line”.

Bottom line: Do your taxes including your “taxable pass rider’s”imputed income, then do your taxes without that imputed income; the difference in tax owed = what your pass riders’travel actually cost you. Ask your pass riders for the $$$, or just say “Merry Christmas”.

C. How much do you pay for EACH of your taxable pass riders?

Oh, you have two EFs and they flew different trips, and your non-dependent children took some trips, or your domestic partner flew all over the place…how do you determine who owes what?

Generate a PASS TRAVEL REPORT on Flying Together > Travel > Pass Travel Report. Choose the date range: November 1, 2013 to October 31, 2014 (only look for flights where the travel date is between Nov 1 and Oct 31).

Your reportshould give a breakdown of who flew where and when and what the imputed income was for each trip. The imputed income, labeled “Pass Tax Value” will be on the left side of the pass travel report. In the screenshot below, it’s $64.74. The total amount of all the “Pass Tax Values” in the fiscal period should equal the amount on the 1099-MISC form United sends you.

The “Tax Withholdings” amount on the right side of the report is an ESTIMATE of what your taxable pass rider may owe you. This estimate is based on 7.65% state tax (if applicable) plus 25% Federal tax. For my son’s trip from SJC-DEN it shows $25.02. Will I pay that amount to the IRS? It depends on my tax bracket and what state I live in.

Note: the Pass Travel Report says my son is a “companion”….that’s incorrect, he is my Enrolled Friend. It also says the Tax Withholdings were “Payroll Deduct”, they were not. The Pass Travel Report is designed for employees, not retirees.

Beware: the Pass Travel Report does not work unless you are using Internet Explorer and both ual.com and coair.com are be selected as "allowed sites" in your Internet Explorer browser’s “Compatibility View”. If you are using an Apple computer try to find someone with a PC to help you….or…..

If you can’t get your PASS TRAVEL REPORT to work, go to employeeRES > QuickLinks > Feedback and send the ETC a message requesting your Pass Travel Report; advise them what date range you want.

There is still a controversy about United reporting the 1099-MISC income in Box 7 or Box 3. If you have a large amount of imputed income, it will make a difference on how much tax you owe. Read the NOTE near the bottom of this document (http://www.rafa-cwa.org/Costs-and-Imputed-Taxes ) and the message from United below (in red) then consult with your CPA:

The following message is from United:

United uses box 7 (“Nonemployee compensation”) of Form 1099-MISC instead of box 3 (“Other income”) to report the taxable income resulting from taxable pass travel because United believes that the income is most appropriately reported there. Since your travel privileges are available to you as a result of your prior services for the Company, and you are not currently an active employee, United believes that your travel-related income is a form of nonemployee compensation that is properly reportable in box 7. While reporting the income in box 3 may also be possible, the Company does not believe that it is the most appropriate means of doing so.

5) Recent news snippets from the United Daily

(archived on Flying Together>News)

12/22: ORD-Rome (FCO) flights this summer!

12/23: Subscribe to United Daily with your personal email

12/30: ORD re-numbers “F” gates to reduce confusion

01/05: WiFi launched on our regional jets

01/08: Airbus refresh is completed

01/14: United and IAM discuss outsourcing/bargaining

01/15: New limited-edition amenity kits for customers!

01/19: Fly to Turks & Caicos (PLS) from EWR & IAH this summer

01/20: Investment is transforming United in many ways

01/20: Delta nets $1.0 billion on total income of $4.5 billion in 2014

01/22: United nets $461 million on total income of $1.97 billion in 2014

01/22:Southwest nets $642 million on total income of $1.8 billion

01/27: AA nets $1.1 billion on total income of $4.2 billion in 2014

6) Have you seen our new website?

Check out the Travel Benefits tab: http://www.rafa-cwa.org

Compiled by Kirk Moore, RAFA Travel Benefits Committee 1/28/2015